How you’ve been misinterpreting the meaning of RBF

by Alize Abbott

In both popular culture and the digital lexicon, "RBF” carries an amusing, albeit non-financial connotation—resting bitch face. Yet, within the corridors of finance and business strategy, RBF unfurls as a critical acronym with a far-reaching impact: revenue based financing. This groundbreaking fundixng model redefines traditional paths to business growth, sidelining equity dilution and loss of managerial control in favor of a more sustainable, growth-oriented approach. The RBF meaning, particularly when explored through the innovative lens of Ratio Tech, shifts from humor to a serious exploration of financial empowerment and flexibility, especially with the advent of BNPL (Buy Now, Pay Later) for B2B transactions.

Unveiling the New Face of RBF

At the heart of revenue based financing lies a simple yet transformative principle: companies secure capital in return for a portion of their ongoing revenue. This model diverges markedly from conventional financing methods, which often rely on tangible assets or equity as collateral. Its appeal is particularly pronounced among SaaS startups and other entities boasting robust, predictable revenue streams, allowing them to fund expansion efforts without relinquishing control or equity.

RBF and BNPL for B2B: Pioneering Flexible Payment Solutions

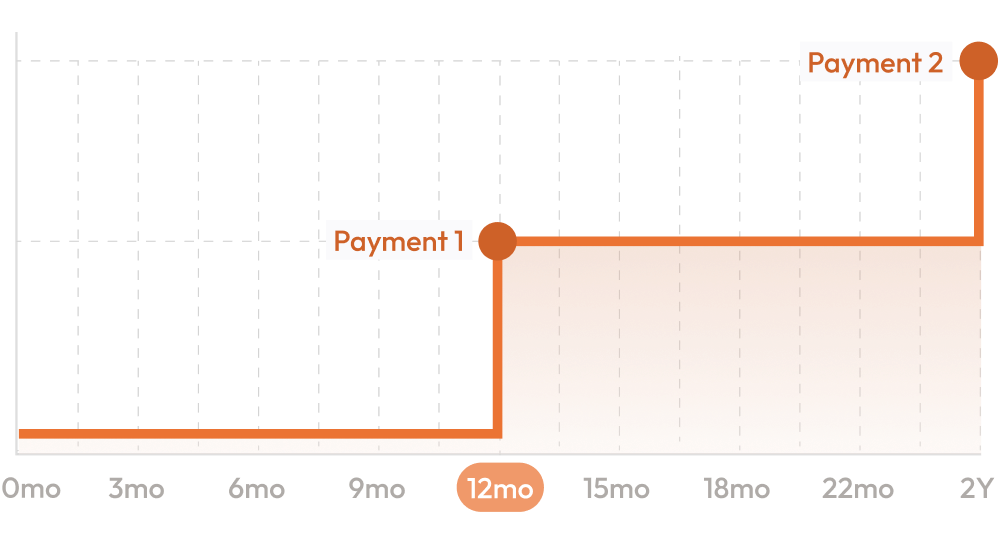

The synergy between revenue based financing and BNPL for B2B arrangements marks a pivotal evolution in how businesses manage cash flow and customer relationships. This model democratizes access to flexible payment options, extending the consumer-centric convenience of BNPL to the B2B sector. Companies like Ratio Tech are at the forefront of this revolution, offering tailored financing solutions that enable clients to defer payments or split them into manageable installments, all while benefiting from immediate funding opportunities.

Case Studies in Innovation and Growth

Leaders in the technology and service sectors, such as Nohtal Partansky of Sorting Robotics and Oz Eleonora of Bitivore, have vocalized the strategic advantages of partnering with Ratio Tech for revenue based financing solutions. Partansky highlights Ratio Tech's unique position in facilitating the transition to Robotics-as-a-service, emphasizing the dual benefits of customer payment flexibility and enhanced enterprise value. Similarly, Eleonora's narrative underscores the importance of liquidity for growth, crediting Ratio Tech's revenue based financing model with enabling Bitivore to optimize cash flow and control destiny, devoid of dilution or unpredictable fundraising challenges.

Empowering Strategic Growth and Operational Flexibility

The integration of revenue based financing into a company's financial strategy fosters unparalleled growth and operational agility. It enables aggressive investment in marketing, product development, and market expansion, with the assurance that repayment obligations flexibly align with revenue performance. This model not only safeguards founder ownership but also opens avenues for future funding rounds without the burden of significant equity dilution.

Choosing the Right Partner: The Integral Role of Ratio Tech

The journey toward leveraging revenue based financing and BNPL for B2B is contingent upon selecting a partner with deep industry insight, a robust understanding of growth dynamics, and a commitment to fair, mutually beneficial agreements. Ratio Tech distinguishes itself as such a partner, offering solutions that resonate with the unique needs of diverse industries, from AI startups to educational platforms.

Redefining RBF: Beyond Just an Acronym

As the business landscape evolves, the meaning of RBF within financial contexts grows increasingly significant. Far from its casual, humorous beginnings, revenue based financing, especially when augmented by BNPL for B2B models, emerges as a cornerstone strategy for sustainable business growth and innovation. With Ratio Tech as a guiding partner, companies are well-equipped to navigate the complexities of modern financing, embracing the true essence of RBF as a beacon of financial opportunity and strategic empowerment.

In this comprehensive exploration of RBF, we've traversed from its cultural misinterpretation to its strategic importance in contemporary business financing. By demystifying revenue based financing and highlighting its synergistic potential with BNPL for B2B, we underscore the imperative for businesses to adopt flexible, forward-thinking financial strategies. As we close this discussion, it's clear that RBF, in partnership with pioneers like Ratio Tech, is not just redefining business finance—it's setting the stage for the next wave of economic innovation and growth.

In both popular culture and the digital lexicon, "RBF” carries an amusing, albeit non-financial connotation—resting bitch face. Yet, within the corridors of finance and business strategy, RBF unfurls as a critical acronym with a far-reaching impact: revenue based financing. This groundbreaking fundixng model redefines traditional paths to business growth, sidelining equity dilution and loss of…

Recent Posts

- The Go-To HVAC And Plumbing Specialists: Exploring The Services Of Hubbard Mechanical

- Lawn Care Spring Branch Advocates for Property Care: Combatting Weed Growth and Preserving Curb Appeal

- Understanding Roof Replacement vs. Repair: When is it Time for a New Roof in Lexington?

- JD Heating and Air Highlights Importance of Regular AC Filter Changes for Better Air Quality

- Top Tips for Selling Your Home Quickly in Arizona’s Competitive Market